Key Takeaways

Key Takeaways

– Investment advisors tend to be adept at asset management.

– Financial advisors and wealth managers generally offer a broad range of financial solutions.

– Virtual family offices generally provide the largest menu of products, services and solutions to clients.

We find that, by and large, people seeking financial advice know to look for a financial advisor who has high levels of integrity and who wants to do what is in their clients’ best interest at all times.

But it seems that fewer people pay attention to the orientation of their financial advisor candidates. As a result, they may risk choosing an advisor who isn’t a great fit.

Here’s a look at four different types of advisors you are likely to encounter and how they stack up against each other in some key areas.

Armed with this information, you should be able to better assess which type is best suited for you based on factors such as your goals, the complexity of your financial situation and your net worth.

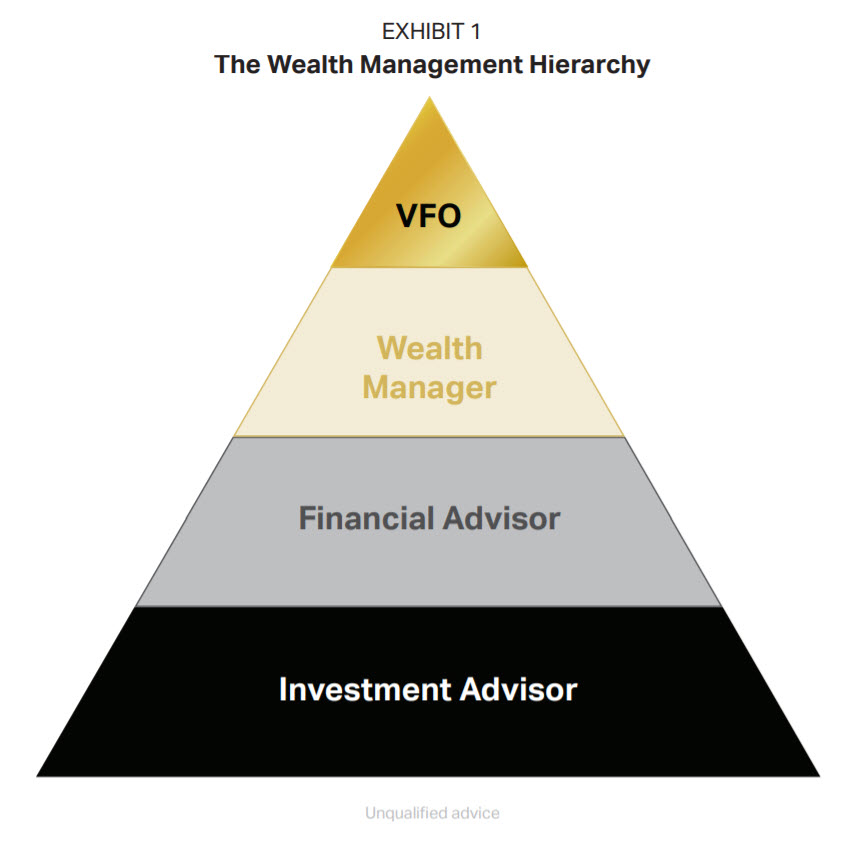

The Pyramid of Capabilities

The wealth management hierarchy illustrates the range, depth and breadth of the financial solutions you can get from different types of advisors (see Exhibit 1).

Generally speaking, the affluent—be they inheritors, executives or entrepreneurs—want to address an array of family, financial and lifestyle concerns. The defining characteristics of these individuals are the multifaceted complexity of their lives and their desire to deal effectively with this complexity.

The upshot: The more complex your life, the more likely you’re going to want to use an exceptional financial professional who is pretty high up in the wealth management hierarchy.

That said, let’s examine each group.

1. Investment Advisor

A good way to think about the wealth management hierarchy is that it’s progressive or additive. We start with the base. Investment advisors are excellent financial professionals who do a very good job managing money—but that’s all they do.

While investment advisors provide a single solution—money management—that one solution can have multiple variations (from securities to investments in private companies, real estate, artwork and so forth).

If all you want is someone who manages your money well—positions your investment capital, reallocates it as needed and so on—you can stop at this level. If you want or need expertise beyond money management, you’ll need to move up the wealth management hierarchy.

2. Financial Advisor

When you move to the next level of the wealth management hierarchy, more types of expertise are available to you. Like investment advisors, financial advisors are primarily focused on delivering money management services and products. However, they also provide some wealth planning services.

The wealth planning capabilities of financial advisors tend to be relatively basic and fall within a fairly narrow range of expertise. This typically makes them appropriate for individuals and families with lower levels of complexity in their financial lives. Again, if your financial situation is not complicated, an expert financial advisor may be what you need to pursue the types of outcomes you want.

3. Wealth Manager

If you work with a wealth manager, you can also get excellent money management services along with planning services. However, the level of services you will receive will be elevated because wealth managers and their teams can address truly complex situations requiring multiple specialties.

The biggest difference we see between financial advisors and wealth managers is that the latter can typically deliver a more extensive and in-depth range of wealth planning expertise. That expertise might include income tax planning, cross-border planning and financial life management planning.

Wealth managers also tend to offer greater coordination of solutions to address their clients’ financial issues and concerns. For example, a client’s tax-mitigation plan might be informed by her charitable giving strategy along with her eventual wealth transfer desires. As a result, none of the strategies work against or conflict with the others. Working with a wealth manager will indeed get you most of the best solutions aimed at helping enable you to achieve a well-structured financial world.

4. Virtual Family Office

The pinnacle of the wealth management hierarchy is the high-performing virtual family office, or VFO. A VFO incorporates exceptional wealth management with robust attentiveness to administrative and lifestyle matters. High-performing virtual family offices are also able to deal with the important one-off special projects that might arise.

By providing extensive and coordinated solutions that address clients’ financial situations and many aspects of their families’ well-being, a VFO can build and protect personal wealth while also making clients’ daily lives much easier.

Not surprisingly, a high-performing virtual family office is not the right choice for everyone— especially if your needs and challenges are not sufficiently complex. But if you need support and capabilities that go beyond the other three categories, a VFO could be a good fit.

An Example

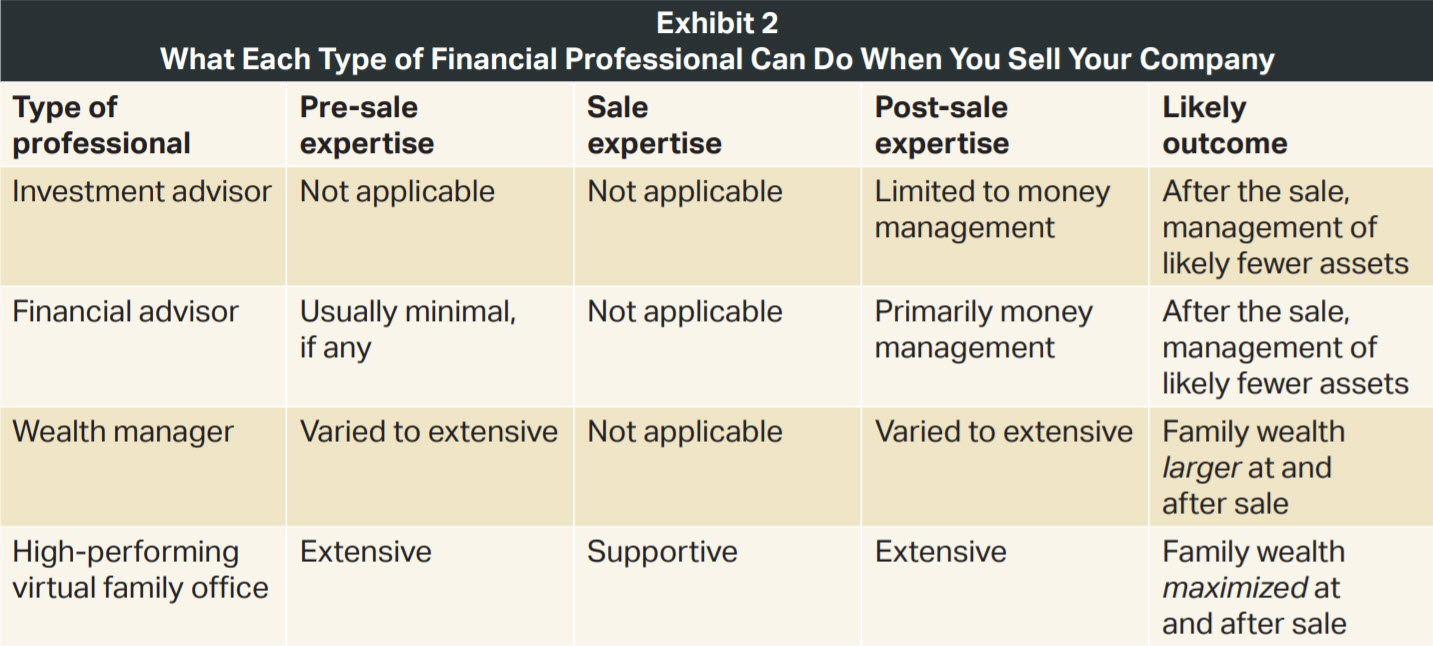

To see how each category measures up, consider the needs of a successful entrepreneur seeking to sell his or her company. The sale of a business can result in substantial liquid wealth—but just how much a business owner ends up with can depend to a great degree on the expertise received throughout the sale process (see Exhibit 2).

Keep in mind that benefits accumulate as you go up each level in the wealth management hierarchy. You continue enjoying the advantages of the previous level and gain many more. For most entrepreneurs selling their companies, a high-performing virtual family office will likely maximize family wealth at and after the sale.

Next Steps

The “perfect” financial professional for you and your family depends on your situation and the level of expertise you need to address your needs, goals and concerns. If you need help only with investments, an investment advisor may be a great fit. However, if you face complexities in a range of non-investment financial issues, then another type of advisor may be necessary. So keep this hierarchy of wealth management in mind as you assess potential advisors. It could help guide you to the right advisor for you.

ACKNOWLEDGEMENT: This article was published by the BSW Inner Circle, a global financial concierge group working with affluent individuals and families and is distributed with its permission. Copyright 2020 by AES Nation, LLC.

Impact Financial Wealth Management, AES Nation LLC and LPL Financial are separate entities.

Key Takeaways

Key Takeaways