Key Takeaways:

- About four out of five single-family offices have significantly increased their use of external experts in recent years.

- Advisors should bring experts in to work on your situation collaboratively and as needed, overseeing the entire process at every step.

- In many cases, cohesive teams are built around individuals and families—and their finances.

Chances are you want top experts working on your behalf to help you address your financial challenges and capture financial opportunities that could potentially make you wealthier. That’s probably especially true when it comes to complex aspects of your financial life—such as asset protection planning and estate planning strategies.

So what’s the best way to find those experts and tap into their capabilities?

As is often the case, the Super Rich—those with a net worth of $500 million or more—offer solid clues for getting the most from our wealth and the professionals who help us manage it.

In this case, we increasingly see that the Super Rich and their professional advisors are looking outside their own circles for top experts. They are reaching out to external experts for advice and capabilities that they feel can benefit them.

This trend has already spread to people who are wealthy but not yet at the Super Rich level. It is impacting the financial lives of individuals and families, and it is likely to have a greater impact going forward.

Here’s how the Super Rich are finding specialized experts—and how you can take a page from their playbook.

The single-family office approach

To see how the Super Rich are accessing top experts, consider what’s happening among single-family offices—structures that many Super Rich families use to help them manage their financial lives.

With the objective of getting the best experts to help them address the needs and wants of the wealthy family, single-family offices—organizations that cater to extremely wealthy families—are increasingly turning to outside experts.

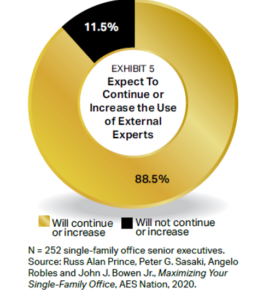

For example, it is very telling that about four out of five of the single-family offices have significantly increased their use of external experts over the past five years (see Exhibit 4). One factor that’s likely driving the greater use of external experts: A majority of single-family offices (61.1%) are being given increasingly extensive mandates—that is, they are being asked to do more and more.

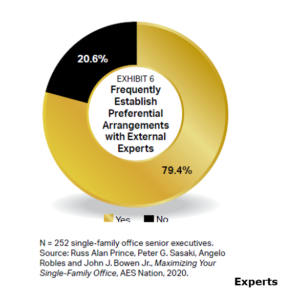

What’s more, this approach is gaining momentum. Looking ahead, nearly nine out of ten single-family office senior executives expect to continue to rely on external experts to the same degree or to increasingly outsource (see Exhibit 5).

Our experience working closely with the Super Rich supports such findings. The most likely way that they consistently find high-caliber professionals is through referrals from other professionals they are currently working with. Many high-caliber financial professionals will often take the initiative and broach the topic of having a client talk to another professional. A proactive professional will understand your latent needs and get out in front of them by making referrals to people who can help you meet them. Indeed, it’s a sign that you’re likely working with a great professional if they proactively introduce you to others who can help you.

What’s driving the trend?

Why are the wealthiest individuals and families (and their professionals) relying on the insights and capabilities of outside experts so much?

One likely reason: They recognize that no matter how skilled their primary advisors are, no single professional is the absolute best at addressing every single financial issue that impacts their lives. The world’s best estate planning attorney is likely not equally good at asset management, for example. Astute professionals recognize this and act on it by surrounding themselves with top talent in areas where they lack the requisite expertise and their clients need guidance.

As a result, the Super Rich seeking to surround themselves with top-tier experts in all areas are actively seeking out that expertise—regardless of whether it is in-house or sourced from an outside person or company.

The good news: You don’t need enormous wealth to benefit from this trend. Advisors who serve affluent people with far less than $500 million in net worth are increasingly taking their cues from the advisors to the Super Rich. They are seeking out top experts by looking beyond their immediate environments, and working with them to help optimize their clients’ financial lives.

Important: What the Super Rich and other advisors to the wealthy are doing here is not outsourcing as you might traditionally think of it—that is, introducing you to another professional with whom you go off to work independently. In stark contrast, these advisors seek out other professionals and then bring those experts in to work on your situation collaboratively and as needed. The advisors work closely with the experts they select and oversee the entire process at every step.

Preferential arrangements with external experts

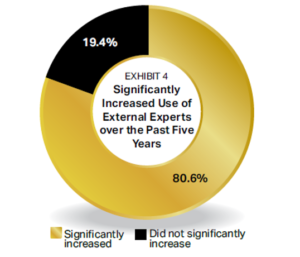

With the extensive and growing use of external experts, a key advantage of single-family offices is their ability to negotiate preferential terms. About 80% report that they frequently establish preferential arrangements with external experts (see Exhibit 6).

The ability to establish preferential arrangements with external experts results from a combination of factors. One key factor is the ability of the professional you currently engage to negotiate well with other professionals. For example, knowing the margins, the compensation structures and the organizational arrangements of the various specialists can be very useful in negotiating preferential arrangements.

That said, there are times when it will be impossible to negotiate a better deal with some specialists. Typically that occurs when an expert has as much work as desired and doesn’t feel the need to bargain on terms.

Implications for you and your wealth

If your goal is to optimize your financial world—and we think it should be—you are likely going to need the services of professionals other than your primary advisor in specialized fields. You might need to access them only from time to time or perhaps quite frequently. That all will depend on your specific situation.

As noted, more and more advisors—prompted in part by advisors to the Super Rich—are engaging with these outside experts and coordinating their efforts on behalf of clients. Their efforts go well beyond simply referring clients to someone and letting the clients take the reins. Instead, these advisors are coordinating the efforts of the experts on behalf of clients. As a result, cohesive teams are built around clients and their finances.

Going forward, it’s likely that we will see even greater use and coordination of outside experts among advisors and wealth managers as the affluent come to expect more and more from their advisors.

The upshot: All of this means that you may have access to more and better expertise than ever before.

LPL Tracking #514954

VFO Inner Circle Special Report

By John J. Bowen Jr.

© Copyright 2023 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, including but not limited to electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the author nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The author will make recommendations for solutions for you to explore that are not his own. Any recommendation is always based on the author’s research and experience.

The information contained herein is accurate to the best of the publisher’s and author’s knowledge; however, the publisher and author can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.