Key Takeaways

Key Takeaways

– An estate plan needs great technical expertise and much attention paid to the human element of planning

– When creating an estate plan, start with the end in mind—the outcomes you most want to see happen in various scenarios.

– Not sure whether your estate plan is on track? Try stress testing it.

Whether you’re fabulously wealthy or on a path that you hope will get you there someday, you probably need an estate plan.

We notice that some people—even those with significant wealth—assume estate plans are only for people with names like Walton, Rockefeller and Musk. That’s just not the case. Estate plans are for anyone who wants to set up a formal process for transferring assets that are currently theirs to other people in the future.

In other words, an estate plan can create assurances that your loved ones will be adequately provided for, financially, once you are gone. It also can better enable you to support charitable causes that are important to you.

If you care about either of those issues, chances are an estate plan is something you should explore.

What Makes An Estate Plan Exceptional?

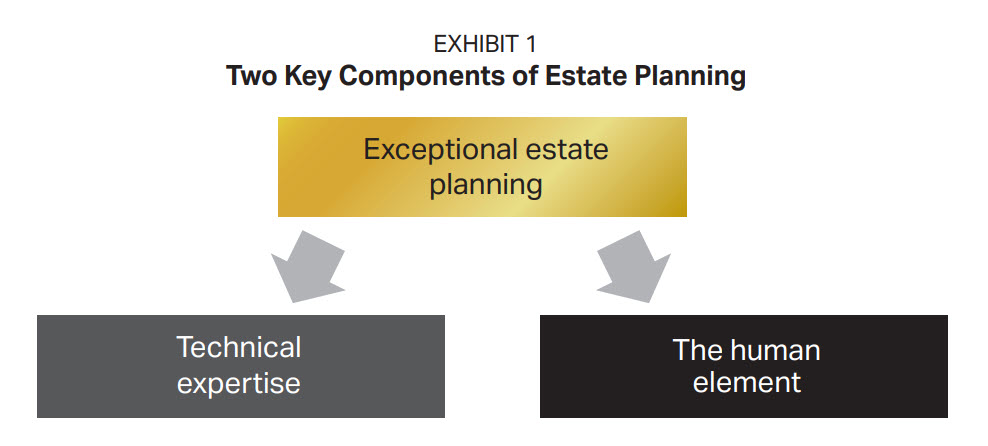

We believe that exceptionally strong estate plans involve two key components:

- Technical expertise consists of the various strategies and tactics—the techniques and methods for structuring your estate.

- The human element is the psychological and emotional aspects of estate planning.

Let’s take a closer look at each.

Technical Expertise

Exceptional estate planning requires exceptional technical expertise about estate planning laws, rules and strategies (some of which can be very complex).

The tools and techniques of exceptional estate planning can range from the basic to the cutting edge. The basics might include the legal strategies and financial products that are readily recognized and generally applicable to many families. More sophisticated solutions could involve discounting and the astute use of financial products in creative ways.

From the technical side, some estate planning strategies and tools you might end up considering include the following:

- Trusts. Trusts are often cornerstone solutions for successful individuals and families. A trust is a means of transferring property using a third party (the trust). Specifically, a trust lets you transfer title of your assets to trustees for the benefit of the people you want to take care of—also known as your designated beneficiaries. The trustee will carry out your wishes on behalf of your beneficiaries.

You can use trusts in all sorts of ways to transfer your wealth and determine how it is to be deployed. Trusts also may be useful in shielding your assets from plaintiffs and creditors. Depending on the kind of trust, there are different tax consequences. - Partnerships. As with trusts, there are many types of partnerships. They can determine how the partners of a business address ownership issues and have varying tax benefits. For example, within the business world, disharmony among family members or unrelated business partners can mean a higher tax bill if the owners are forced to divide assets among the business’s members. Through the use of sophisticated partnership structures, business owners can divide their companies—and possibly eliminate taxes.

The Human Element

It’s important to recognize that the true goal of exceptional estate planning is to transfer your wealth in accordance with your wishes. Tax mitigation, while often important and beneficial, should not be the overriding driver of your estate planning decisions. The role of an estate planner—who may be a top lawyer, accountant or wealth manager—is to make it possible for you to achieve your desired agenda and to be as tax efficient as possible in pursuit of that agenda.

That’s where the human element comes into play. While technical expertise is absolutely required, it is the human element—understanding your agenda and designing a plan around it—that separates good estate planning from exceptional estate planning.

That’s because today, the same estate planning legal strategies and financial products are available across the board to any high-end estate planner. So a big difference between plans and planners—and plan outcomes—is the ability to put the pieces together so that you get the results you’re seeking.

Clearly, then, an estate planner you work with should have a deep understanding of you— your situation, your values, your goals and your concerns. Without that knowledge, the tools themselves (good as they may be, technically) might not get you what you want because they’re not the appropriate ones for the job you want done.

Put it this way: A band saw is an effective tool—but you wouldn’t try to hang a picture with one!

Pro tip: Don’t get so wrapped up in any particular strategy that you overlook what you want to achieve and what strategy is best for that goal. And don’t let an estate planner do so either.

A Process To Follow

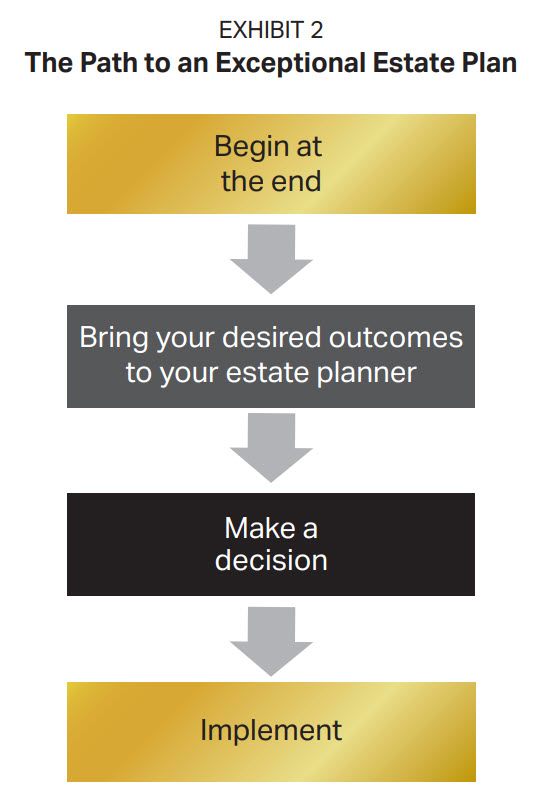

There is a process you can follow that we believe can potentially increase your chances of ending up with an exceptional estate plan that satisfies the technical and human aspects (see Exhibit 2).

1. Begin at the end. Start by thinking through what you want to have happen—the outcomes you ideally want to see occur. Let’s say there is you, your spouse and your children. In that case, there are four scenarios to consider:

- You die.

- Your spouse dies.

- You and your spouse die simultaneously.

- Your whole family is in a disaster and dies.

For each of these possibilities, you need to specify what happens to your assets—life insurance proceeds, property, investments and so on. You’ll also need to decide who is in control at different points in time—making decisions such as when your children will have control of the assets.

2. Bring your desired outcomes to your estate planner. Share your desired results in each scenario with an estate planner whom you find to be highly capable. He or she should be able to come up with ways to enable you to best achieve your preferred results. Your estate planner will also likely be able to provide additional perspective and recommendations, and help you revise and hone your desired outcomes (if necessary).

3. Make a decision. Based on input and insights from the estate planner, choose a course of action.

4. Implement. Once you have made a decision, the estate planner will formalize everything and create the estate plan. This step is actually the easiest part, as all the hard work— thinking through goals and possibilities—has already been done.

Don’t Set It And Forget It

It’s very important to recognize that an estate plan—even one that you deem to be exceptionally strong—is not set in stone. A lot in life changes over time. You might become wealthier. The nature of your relationships might change. New tax laws might get put on the books. These and other changes mean that your estate plan should periodically be reexamined and revised, if necessary.

In short, it’s best to think about your exceptional estate plan as perpetually being a work in progress.

If you have any doubts about whether your estate plan is likely to achieve your wishes, consider stress-testing it—that is, have your wealth manager review the plan and your particular personal situation to answer two questions:

1. Is the plan likely to deliver the outcomes you currently want?

2. Is the plan missing anything that can make it more effective or efficient?

Ideally, a stress test will reveal your plan is still on track. But if it suggests there are changes that should be made, you can then consider taking steps to realign your plan with your key estate planning goals.

Next step: Contact your financial and/or legal professional(s) to discuss your estate planning goals and the strategies that could potentially help you achieve them.

ACKNOWLEDGEMENT: This article was published by the BSW Inner Circle, a global financial concierge group working with affluent individuals and families and is distributed with its permission. Copyright 2020 by AES Nation, LLC.

Impact Financial Wealth Management, AES Nation LLC and LPL Financial are separate entities.

Key Takeaways

Key Takeaways