Key Takeaways

Key Takeaways

– There are two main types of life insurance—but lots of permutations.

– When shopping for life insurance, consider what you want it to accomplish.

– A high-quality professional may be helpful in navigating the world of life insurance.

Life can be complicated. So can life insurance. But while we can’t tell you the meaning of existence, we can help shed some light on the basics of life insurance.

Two Main Types

Despite its many permutations, life insurance at its core can be a versatile financial product that can be used to protect the wealth of heirs, ensure the continuity of a business, facilitate charitable giving, and even generate a financial return for policyholders.

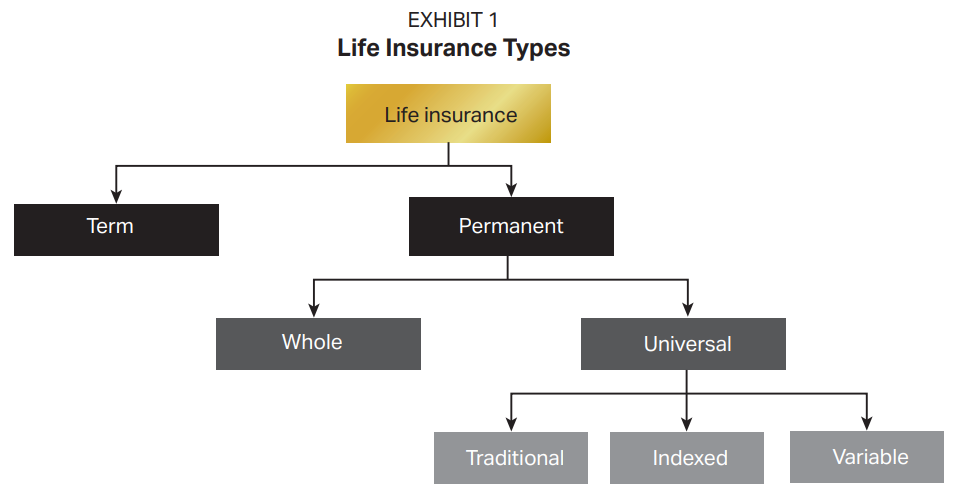

What is often useful is understanding the principal differences among the types of life insurance. As seen in Exhibit 1, the two main types are term insurance and permanent insurance—and there are various iterations in the “permanent” category.

Key Characteristics

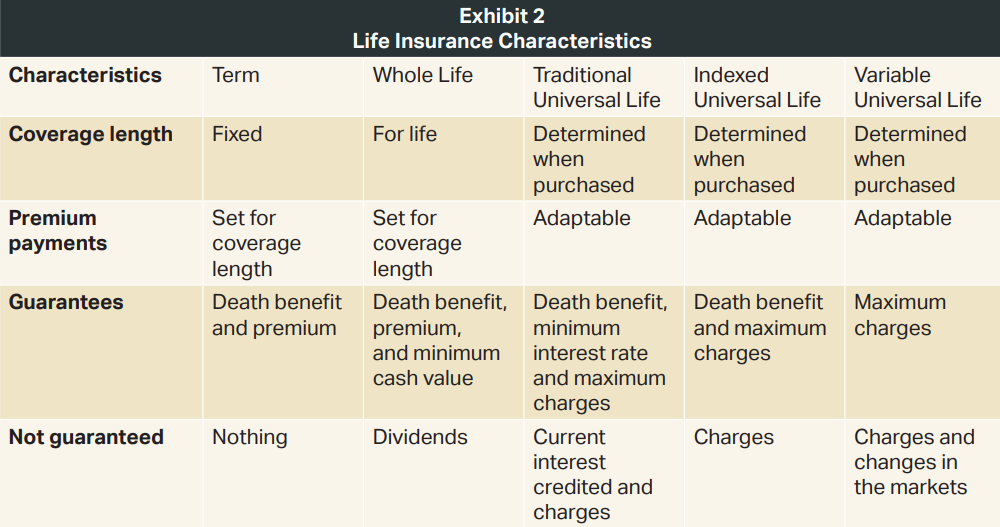

The various types of life insurance have different characteristics (see Exhibit 2). A key defining difference between the two core types of life insurance—term and permanent—is that the premiums paid for permanent life insurance are for the death benefit (i.e., the amount your family receives when you die) as well as for a type of savings account. The money in the savings account grows tax deferred—that is, you don’t pay taxes on the growth of the money in the savings account while those funds are in the account.*

Since this is a lot to take in, let’s explore each type of policy more closely.

Term Life Insurance

With a term life insurance policy, you are buying a specified death benefit, known as the face amount, for a defined period of time. How long the term life insurance policy will stay in effect is decided by you and is usually specified in terms of the number of years. For example, the term life insurance policy might be for ten or 20 years (or even longer). But it could also be set up to stay in effect until a particular date, such as to age 70 or 80.

In most cases, the cost of the term life insurance is set when you buy the policy. The premium payments are fixed and guaranteed for the duration. These are referred to as level term life insurance policies. The premiums stay the same throughout, as does the death benefit.

Note: Some term life insurance policies allow you to increase or decrease the size of the death benefit. If you do so, the cost of the term life insurance policy will change.

Another type of term life insurance policy is called “renewable.” You buy a term life insurance policy for a certain number of years—ten years, let’s say. When the policy duration ends, you can renew without having to demonstrate whether you’re still healthy enough to be insurable. When you renew, however, the cost of the policy rises.

Yet another type of term life insurance policy is called “return of premium.” It gives you back the cost of the policy if you survive for a predetermined amount of time. You also may be able to reenter the policy and pay a lower premium at the time of renewal (provided you meet certain insurability criteria). Return of premium insurance may be significantly more expensive than the other types of term policies.

Important: Unlike permanent life insurance policies, term life insurance policies are purchased strictly to provide a death benefit—they don’t have any cash value savings account, as do permanent life insurance policies. That said, term life insurance policies may include a convertibility provision that allows you to switch to a permanent policy without having to show insurability.

Whole Life Insurance

Whole life insurance is, as the name suggests, for the whole life of the insured. You pay premiums that have been determined to keep the policy in force for your lifetime. These premium payments stay the same each year, with some of the payments put into a savings account. The insurance company manages the money in the savings account and guarantees a minimum interest rate.

You can borrow money from the savings account (you have to pay interest, of course) and can add optional riders and benefits to your policy. One example: a rider that can provide money to you to use during treatment you receive if you become critically ill.

Bonus: Some whole life insurance policies let you share in any distributions of surplus funds the insurer decides to make.

Traditional Universal Life Insurance

Traditional universal life insurance policies have many of the same characteristics as whole life insurance policies, but they are more adjustable—you can change the amount and duration of your premiums and still ensure coverage for your entire life. (However, there must be money in the saving account to do this.)

Each month, the money in your savings account is credited with interest. The insurance company decides on the interest rate, but there can be a guaranteed minimum interest rate.

The death benefit can either be set in advance or increase annually based on the amount of money in the savings account or on the paid premiums. In addition, loans can be taken out of the savings account, and riders can be attached to the policy.

Indexed Universal Life Insurance Policy

This is a variation on traditional universal life insurance. It works largely the same way as traditional universal life, but the interest rate is determined by an equity index (the S&P 500, for example). Because it’s tied to the performance of a stock market index that will fluctuate in value, an indexed policy may potentially generate greater returns than a traditional universal life insurance policy that is assigned a fixed interest rate by the insurance company.

Variable Universal Life Insurance Policy

Variable universal life insurance is yet another variation on traditional universal life insurance. Instead of the insurance company or an index being used to determine the performance of your savings account, you can choose from a list of investments in which the money in your savings account will be allocated.**

Working With a High-Quality Professional

We believe this very simplified overview shows the importance of working with a high-quality professional when it comes to purchasing the life insurance that would likely best meet your needs and wants. Actual policy documents tend to be obscure and opaque to most people, and they can become even more so when riders and other add-ons are considered.

Even when working with a talented life insurance professional, you always need to concentrate on what you are aiming to accomplish by purchasing life insurance. Because of its versatility, life insurance can be beneficial—that is, as long as your choice aligns with your agenda.

Next step: Reach out to your financial and/or legal professional to discuss any insurance questions or needs and which type or types of policies might be best for you.

*Disclosure: Tax laws are subject to change, which may affect how any given strategy may perform. Always consult with a tax advisor

**Disclosure: Investments carry risk of loss and returns are subject to performance of investment vehicles.

ACKNOWLEDGEMENT: This article was published by the BSW Inner Circle, a global financial concierge group working with affluent individuals and families and is distributed with its permission. Copyright 2020 by AES Nation, LLC.

Impact Financial Wealth Management, AES Nation LLC and LPL Financial are separate entities.

Key Takeaways

Key Takeaways