Key Takeaways

Key Takeaways

– Very wealthy families typically take a formal approach to family governance.

– Both the human/relationship and technical aspects of a family governance plan must be addressed.

– Financial professionals can help families create a governance plan and work to ensure it’s followed and respected over time.

“Shirtsleeves to shirtsleeves in three generations” is a well-known saying among many affluent families. It means family wealth that’s built by the first generation is eroded or even destroyed by the third generation, which squanders the assets it inherits through reckless spending, poor investment decisions and other mistakes.

The result: The family ends up back where it started, with the same amount of wealth (or less than) it began with generations ago.

Unfortunately, it’s not just an adage. We’ve often seen this type of wealth destruction play out among affluent families, whose members tend to have conflicting agendas. They have (to varying degrees) different expectations, wants and preferences. When there is significant family wealth, the possibilities available to family members often multiply. Moreover, there are commonly clashing perspectives on how best to manage and spend the family wealth. Within an accomplished wealthy family, there may be business interests that are family owned and managed, and different family members may have differing ideas about the future of the company.

The good news: You can take steps right now that can potentially help you avoid watching your family’s wealth diminish over time—or stop you from being part of the problem. The key is to implement a process known as family governance.

Here’s how family governance works—and how it may help your family preserve, protect and grow its assets for generations to come.

Formalizing Family Governance

Family governance at its core seeks to balance the competing needs of family members when there is substantial family wealth (and possibly business interests). But how family governance is structured can make a big difference. For example, addressing competing family members’ needs can happen by default without any real planning or formal structures. In such instances, control of the wealth is often concentrated in the hands of a matriarch or patriarch, or it changes as alliances among various family members shift.

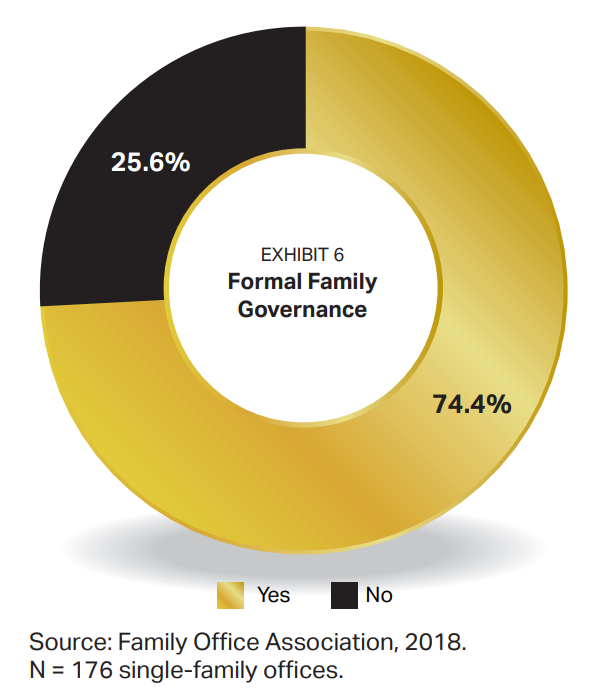

Or it can be done formally, by setting up approaches and controls designed to actively promote the betterment of the family overall. The very wealthy tend to take this approach: In a Family Office Association survey of 176 single-family offices, three-quarters said they have (or are instituting) formality in their approach to family governance (see Exhibit 6).

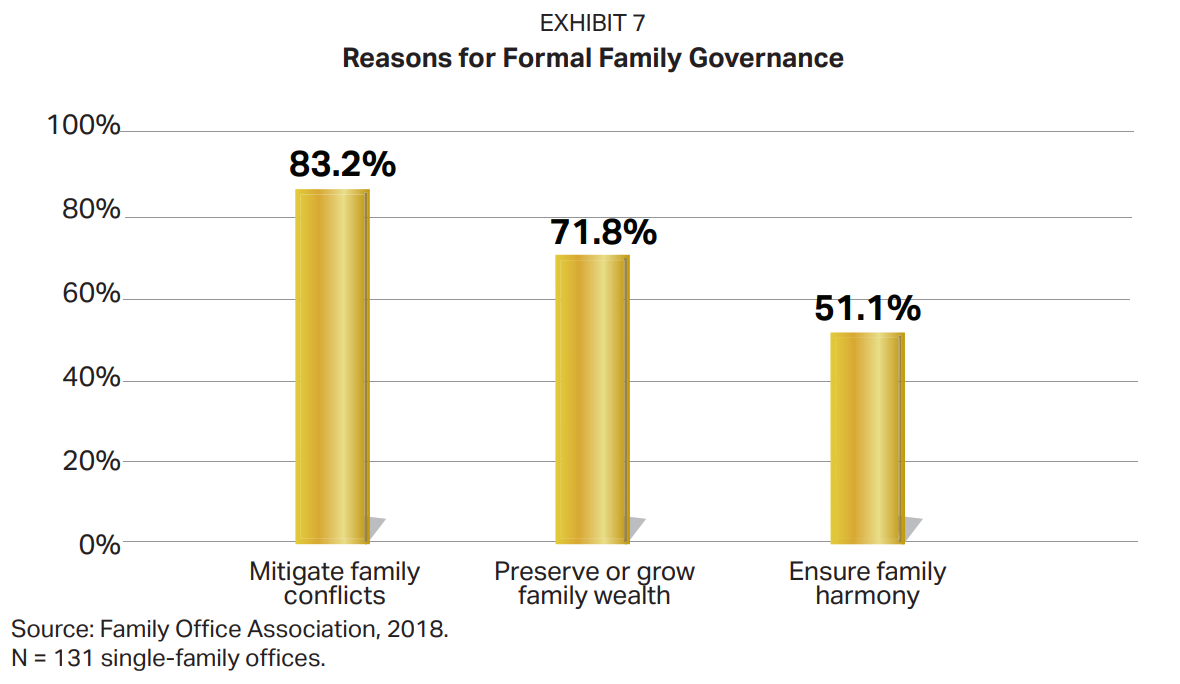

The rationale for doing so is to inject some stability into the family’s wealth and potentially head off conflicts that might otherwise arise over money (see Exhibit 7).

The Nature of Formal Family Governance

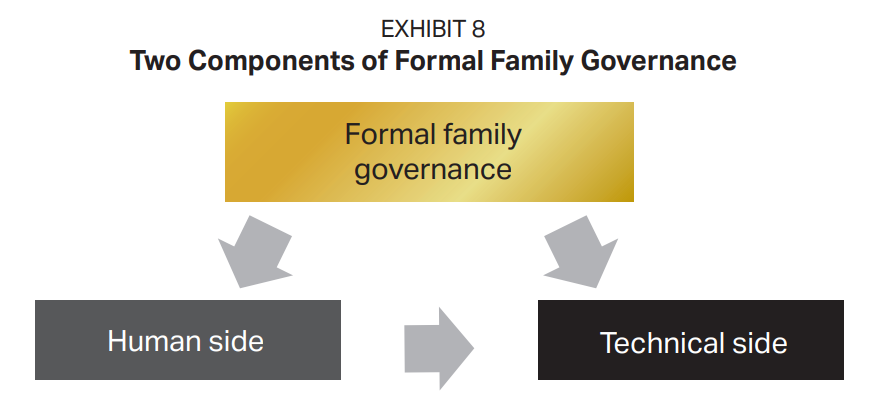

Formal family governance has two core components: the human side and the technical side (see Exhibit 8).

The human side tends to involve the steps taken to identify and create documents like mission and value statements and family constitutions. It is about developing a strong understanding of what the family is all about—including the roles and responsibilities of family members as a group and as individuals. Another aspect of the human side is specifying how family conflicts are to be resolved. The objective is to avoid litigation and all the associated detriments (such as bad publicity). The aim is also to make conflicts less intense and more manageable.

The technical side of family governance involves legal structures such as trusts, partnerships and corporate entities, as well as contracts (such as prenuptial agreements) that officially codify the way family governance will work. Obviously the human side can strongly influence the technical side. In our experience, family dynamics almost always impact the types of legal structures a family chooses to implement for governance purposes.

Various professionals—including wealth managers, attorneys and even family counselors—are often instrumental in helping families develop a formal family governance plan and help keep it on track during good times and bad.

Challenges in Implementing Family Governance

With family governance, the biggest challenge is often following through on the plan and getting whatever model of governance you choose to work.

Example: Addressing only the human side of family governance can lead to disaster. Consider one billionaire family that spent hundreds of thousands of dollars on advisors to help them understand the wishes of family members and (through mediation and family group activities) produce a mission statement, a values statement and a comprehensive family constitution. All the family members formally signed on to these documents. A well-articulated and robust process for dispute resolution within the family was also put in place. The aim was to create a family dynasty that would grow continually wealthier over the generations.

Everything went fine for nearly a decade. Family members through their words and actions validated the statements and family constitution. But when the parents passed away, the heirs ended up at odds with each other. The agreed-upon approach to dispute resolution was jettisoned, replaced with vicious litigation.

In retrospect, it appears that many family members supported the values and mission of the family simply to appease their parents. Once the parents were gone, the values changed—and there were no formal, legal documents in place to help ensure decisions in line with the agreed-upon values were made.

Likewise, addressing only the technical side can result in problems down the line. Consider a self-made billionaire who was not comfortable leaving his wealth and his companies to his children and other relatives, fearing they would fight over the assets. He also questioned their ability to effectively manage the assets and the companies.

To deal with his concerns, he established a series of trusts that tightly specified how the family members were to govern themselves and benefit from the fortune and businesses he created. For example, there were values the family members had to embrace to be able to access the assets. A mediation process was also set up to deal with conflict.

In this case, after the passing of the self-made billionaire, the family went to war—not against each other, but rather against a common enemy: the trustees of the trusts. Because the trusts relied on only technical solutions, they were quite rigid. Their lack of flexibility generated problems for the family members, motivating them to sue.

These two extreme and opposite family governance cases produced results that family governance is actually intended to avoid. That’s because in each case the family dealt with only one aspect of governance, instead of addressing the full range of issues needed to establish effective family policy.

Building a Solid Plan

Family governance can be quite advantageous for family members. It can result in the further creation of wealth and the wise transfer of wealth from generation to generation. But to achieve these outcomes, family governance should be done thoughtfully and carefully—by both making a formal plan and then ensuring that the plan adroitly combines the human and technical aspects involved.

Next step: Contact your financial and legal professionals to discuss the various goals and objectives of your family members—and how a family governance plan could potentially help address family wealth and family harmony for years to come.

ACKNOWLEDGEMENT: This article was published by the BSW Inner Circle, a global financial concierge group working with affluent individuals and families and is distributed with its permission. Copyright 2020 by AES Nation, LLC.

Impact Financial Wealth Management, AES Nation LLC and LPL Financial are separate entities.

Key Takeaways

Key Takeaways