Also published on WealthManagement.com.

Key Takeaways

Key Takeaways

-Quick responses to problems and opportunities don’t always lead to good results.

-Thoughtful action rooted in your goals and in deep insights into a situation can create much better outcomes.

-Accept your emotional reactions to big-moment situations—but don’t let them drive your decisions.

When people are confronted with adversity, opportunity or both, they often react quickly—with the intention of dealing with the situation rapidly and moving forward.

These reflexively gut-driven responses are often rewarded by our culture, which praises the “fast-acting do-er” who “gets the job done” or “puts out fires.”

Trouble is, rapid action can often result in adverse outcomes. When that happens, you might fail to get the desired result while simultaneously making matters worse due to unforeseen and unintended consequences.

The self-made Super Rich—those with a net worth of $500 million or more—are different, in our experience. Instead of instantly reacting to situations, we find that they approach the good and bad moments strategically. They feel the same emotions as anyone else—but they don’t allow those emotions to drive their decision-making.

Instead, the self-made Super Rich have a habit of prudently thinking through the problems and opportunities they face—often in partnership with professional “sounding boards” with whom they discuss ideas and questions. When they do act, it’s usually only after they have a solid understanding of all the facts and possibilities—as well as what they see as the likely outcomes of their possible responses.

Here’s what many of them do differently—and how you can emulate them when you face your own challenges and opportunities.

Start With Long-Term Goals

One key trait of the self-made Super Rich is that they almost always have significant long-term goals that serve as the basis for their decision-making when “big moment” situations come along.

For example: Becoming extremely wealthy is (generally speaking) a long-term endeavor. Therefore, reaping the greatest rewards requires having long-term goals and making sure they guide your behavior. The self-made Super Rich carefully incorporate their long-term goals when they make business and other financial decisions and take resulting actions.

Your job, therefore, is to become very clear about your own long-term goals and then keep them top of mind when taking significant actions—especially in moments when fear or greed want to take over. Those long-term goals can be very useful in helping you stay focused on what is (and what is not) truly important and essential. They can help you stay motivated and avoid “shiny objects” as well as help you persevere through difficult times.

Consistent awareness of your long-term goals can also enable you to better prioritize. By looking at situations through the lens of your long-term goals, you are able to stop and think rather than be taken over by nervousness or impatience.

Your long-term goals also help you deal with the internal battle between immediate and delayed gratification. Focusing on your long-term goals is useful in staying on track and not making fast decisions without understanding the ramifications of those decisions.

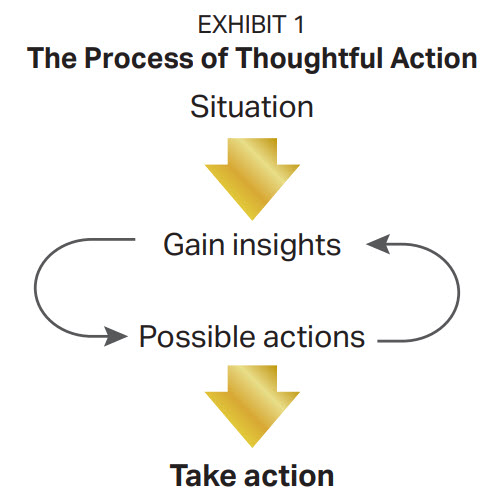

The Process of Thoughtful Action

The first objective of thoughtful action is to not act rashly—don’t leap before you look (and think!). Don’t be unduly swayed by emotions, social pressure or anything outside the merits and possibilities of the situation.

Our experience working with the self-made Super Rich (as well as those fast-tracking to financial elite status) reveals that they tend to detach themselves emotionally when big moment situations arise. They actively work to ensure their feelings and sentiments do not control them so they don’t make decisions out of anger, insecurity, frustration or greed.

One feeling that can prove to be especially challenging is the fear of losing out. This fear is a major reason why many people act quickly—often too quickly. It’s likely that you’ve been in situations where you felt that a business or other financial opportunity would pass you by forever if you didn’t move on it immediately. Of course, sometimes there is a window of opportunity that will close. Miss it, and you will fail to take advantage of a possible opportunity.

But in many, many cases, people actually impose their own artificial deadlines and worry about scarcity where none exists. Unless you can confirm that moving quickly is essential to success, you are usually best served by stepping back and giving yourself time to think things through.

By critically evaluating situations before reacting, the self-made Super Rich are often able to create important psychological distance—enabling them to critically and effectively evaluate the conditions and circumstances. This can generate deep insights that help reveal new possible courses of action that may not have been obvious right away. The “formula” looks like this:

Time + Resources + Rational Perspective = Insights

Take a business deal, for example. By gaining insight into it, you may be better able to see all the various issues and considerations. You are therefore less likely to get so enamored of the potential returns that you fail to see the possible flaws.

The Super Rich also tend to seek out advice, insight and perspective on various situations they find themselves in from people they trust and value. These people might include older business mentors, wealth managers, other legal and financial professionals, or even just friends who are good listeners and critical thinkers. All of these people can serve as sounding boards to help assess scenarios and potential action steps with clear eyes.

Armed with deep insights you’ve gained from your own work as well as from your sounding boards, you can take the step of evaluating your possible actions. The self-made Super Rich regularly consider different scenarios, framing them by asking themselves questions such as:

- What are the advantages and disadvantages of the different courses of action available?

- What are the implications for the people involved?

- What are some collateral outcomes how will they affect the results I am looking for?

Keep in mind, you might end up going back and forth between gaining insights and evaluating possible actions multiple times. That’s a good thing! The more you learn, the more information you need to incorporate, producing a feedback loop. Do this until you are confident that you have the knowledge you need to make a truly well-informed decision.

At that point, it will be time to take action. Good or bad, the decision you make is likely to be the best one possible under the circumstances.

Conclusion

Don’t act spontaneously by leaping before you look. Instead, step back. Put your visceral reactions aside. You need to recognize that it is sometimes quite hard not to be swept up in something that, at first glance, appears extremely promising or terribly problematic. The key is to accept your emotional reactions but not take action. Only by replacing emotion with reason—which includes a focus on your long-term goals—can you critically ascertain the true worth of an opportunity or how to best resolve a problem. That’s when you will likely get the outcomes you are seeking.

While this thoughtful-action approach might not get you perfect outcomes, we believe it is highly likely to get you outcomes superior to the ones you’d achieve by reacting without thinking everything through.

ACKNOWLEDGEMENT: This article was published by the BSW Inner Circle, a global financial concierge group working with affluent individuals and families and is distributed with its permission. Copyright 2020 by AES Nation, LLC.

Impact Financial Wealth Management, AES Nation LLC and LPL Financial are separate entities.

Key Takeaways

Key Takeaways