Key Takeaways

Key Takeaways

-Wealth managers generally provide a broad array of services to clients.

-It’s common to find a combination of in-house and outsourced expertise among today’s wealth managers.

-Concerns around control, cost and other factors often determine the extent that “virtual” expertise is used.

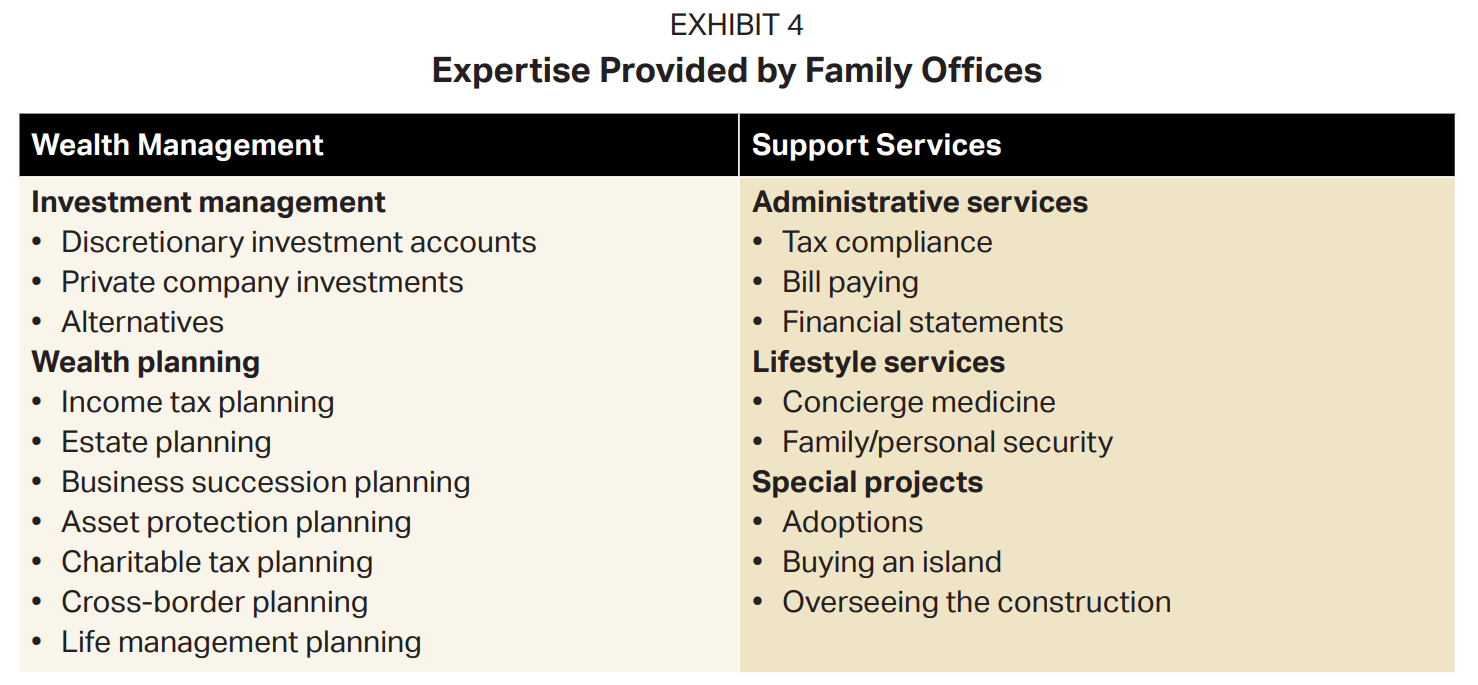

When seeking to manage wealth effectively and optimally, sourcing experts from multiple areas can be highly beneficial. That’s a lesson we’ve learned from a great number of family offices—organizations that deliver a suite of wealth management and support services to their wealthy clients (see Exhibit 4). Under the rubric of wealth management, there is usually investment management and wealth planning. Support services generally encompass administrative services, lifestyle services and special projects.

As you might know, family offices tend to serve the Super Rich—people with a net worth of $500 million or more. Family offices can be traced back as far as the sixth century, when a king’s stewards played a dominant role in managing the royal wealth. The modern concept of the family office came together in the 19th century with the likes of the Morgan, Rockefeller and Carnegie families.

Today, the appeal of the family office appears to be stronger than it has ever been, given how much private wealth is being created worldwide.

The good news: Because of advances in technology, coupled with the ability to bring more sophisticated wealth management solutions to a broader (and less affluent) cohort of families, the family office concept and approach is gaining traction among the “merely affluent.”

The Virtuality Trend

Family offices originated as organizations catering to the diverse needs, wants and preferences of a single (and exceptionally wealthy) family, and that’s how many of them still operate today. But there also are family offices working for more than one family, known (not surprisingly) as multifamily offices.

Historically, family offices were self-contained, possessing all the expertise the extremely wealthy family required “in house.”

But that’s changed. Today, the totally self-contained family office is the anomaly—and that’s meant important changes for other families seeking a family office-style approach.

Increasingly, family offices leverage external experts—a practice known as virtuality or outsourcing. The degree of outsourcing produces virtual family offices that rely to varying

degrees on external experts.

When it comes to single-family offices, which serve one family, virtuality comes about by subtraction and addition. Some services—wealth planning, for instance—may be taken out of the organization, and cutting-edge lawyers are hired on an as-needed basis. Virtual single-family offices are additive in that they might add more capabilities by going to external authorities when particular specialists are required.

Then there are multifamily offices, which serve multiple affluent families. They are considered virtual when they have a core set of expertise they provide to an affluent family and then coordinate external experts for other services. The core set of expertise provided in-house can be anything—but the focus is often on investment management or administrative services.

If you think the virtual multifamily office model sounds more than a bit like the approach used by many elite wealth advisors and wealth planners, you’re correct. The growing ability to outsource effectively, particularly through the use of technology, is enabling advisors to bring a family office-type experience to families who are nowhere near the level of the Super Rich.

Determining the Level of Outsourcing

The degree of virtuality among family offices is usually a function of family and business decisions. The family office can be quite lean, engaging an extensive array of external experts. Or it can be very autonomous, turning to external authorities very rarely.

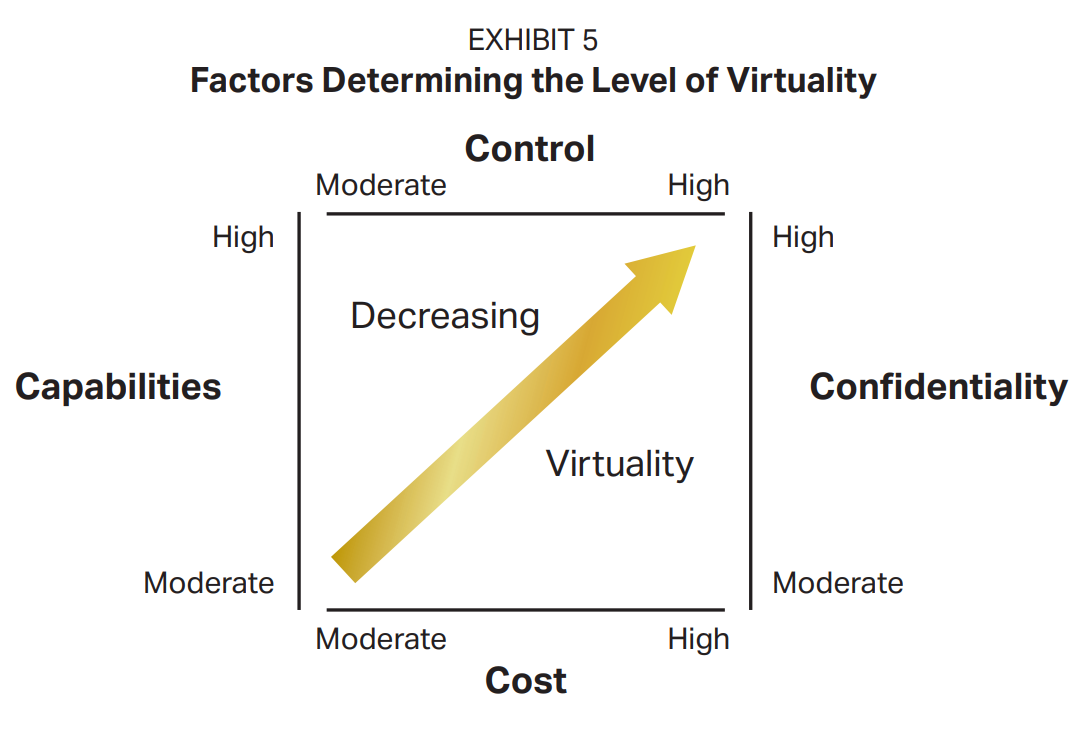

Typically, there are four major factors involved when deciding on the level of virtuality (see Exhibit 5).

Factor #1: Control

The primary reason for establishing a single-family office is control. It is a lesser motivation for families joining a multifamily office. Generally speaking, the more control a wealthy family

wants, the less the family office can be virtual.

When it turns to external authorities for services and products, a family office’s influence is mitigated. For example, the wealthy family is not calling all the shots, as there are other clients and other demands on the time and capabilities of the external experts.

Factor #2: Confidentiality

The more the wealthy family is meaningfully concerned about privacy, the less virtual the family office can be. The more the expertise is in-house, the more it is possible to limit the leaking of information. Of course, there are no ways to ensure privacy is always protected, but legal mechanisms such as strong nondisclosure agreements and strict oversight can potentially make it more likely confidentiality will be maintained.

The use of external experts means that information is being transferred to other people and organizations that might—in reality—not be as attentive to protecting information. Simply put, the more people who are familiar with sensitive information, the more likely it is to leak.

Another issue concerning protecting confidential information is computer hackers. The more firms that have a family’s confidential information, the more opportunities there are for the information to be stolen in a hacking incident.

Factor #3: Cost

The cost of exceptional expertise is a big factor. The wealthy (and most everyone else, for that matter) want to work with the best of the best. The complication is that truly top talent is typically quite expensive. Being as good as they are, they are in demand and can charge premium (albeit competitive) rates. Additionally, many experts are needed only sporadically. So it is often much less expensive to engage talent when appropriate than to employ that talent full time and waste it due to infrequent use.

Currently, some single-family and multifamily offices are finding that it is cost-effective to bring certain experts in-house. The demand for their specialized skills and knowledge is great enough to justify the expense. For example, a global family office built its own internal team of investment bankers because it is putting billions of dollars into buying companies throughout the world. One multifamily office brought top-notch private client lawyers in-house because enough families in the office needed their services to justify the cost.

The more cost is a factor in the decision, the more virtual the family office can be.

Factor #4: Capabilities

Virtuality results in just about any family office having greater capabilities. There are constraints involved in having all your experts in-house. Expense is one constraint, but there are also managerial issues that can arise.

And even when family offices bring their talent in-house, they usually still rely on boutique specialists. Currently, it is impossible to have all the experts who might ever be needed. The more diverse the needs of the wealthy family, the more external experts will be called on and the greater the virtuality.

The Case for Virtuality

These four factors interact, of course, and the balance between them impacts the extent to which a family office is virtual. However, while a small percentage of single- and multifamily offices are adding to their ranks by bringing more talent in-house, most are embracing virtuality more and more—largely because of the cost benefits and the ability to increase the capabilities of the office.

This is excellent news for lots of families who have significant wealth but aren’t Super Rich (yet). As virtuality picks up speed and becomes more common across the spectrum of wealth management, we’re seeing more and more advisors being able to emulate fundamental aspects of the family office approach. These advisors are using virtuality to bring in highquality expertise that typically wasn’t available to them in the past—while also being able to maintain high levels of confidentiality and control.

In short, the trend toward virtuality could mean more and more investors could be getting a family office-style experience—without needing traditional family office-style wealth to get it.

ACKNOWLEDGEMENT: This article was published by the BSW Inner Circle, a global financial concierge group working with affluent individuals and families and is distributed with its permission. Copyright 2020 by AES Nation, LLC.

Impact Financial Wealth Management, AES Nation LLC and LPL Financial are separate entities.

Key Takeaways

Key Takeaways