Key Takeaways:

- The financial succession plan addresses ownership concerns in the context of taxes, legal control and related issues.

- The operational succession plan deals with matters such as governance and management structure.

- The best succession plans are flexible and capable of adapting to unforeseen events.

If you own a family business and want to pass that business down to the next generation at some point, a business succession plan is a key tool to have in your arsenal. Without it, you run the very real risk of creating family conflicts that can jeopardize the future of the company you’ve worked so hard to grow.

To help you determine whether a business succession plan is right for you, some of the questions you might want to consider include the following:

- Does it make sense to continue as a family business or is it smarter to sell the company now as it presently has significant value?

- Are the potential inheritors of the family business up to the task of capably managing the company, and if not, what steps are needed to ensure the continuity of the family business when it is transferred?

- What will be the arrangement between equity inheritors who work in the family business and those who have chosen not to?

If you decide to keep the family enterprise in the hands of the family, a succession plan is needed.

Financial and operational

To get started on the right track in terms of planning, it’s helpful to understand the two main types of family business succession plans.

With the intent of transferring control and ownership of the family enterprise to the next generation, there are two major considerations:

- The financial succession plan addresses ownership concerns in the context of taxes, legal control and related issues.

- The operational succession plan deals with matters such as governance, management structure and ensuring the requisite expertise to run the family enterprise.

Let’s examine each one more closely.

The financial succession plan

Financial succession planning is all about transferring the equity in the family enterprise to future generations. Very often, critical to the effectiveness of the financial succession plan is its ability to mitigate taxes on the transfer. Having a financial succession plan not only can result in paying lower taxes but is many times essential for minimizing or eliminating serious family conflicts.

Because of the level of wealth involved and the near-universal desire among affluent business-owning families to mitigate taxes, financial succession planning tends to make use of various types of trusts and life insurance.

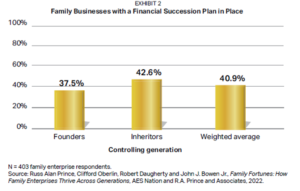

Unfortunately, our research found that most family businesses across the generations are not paying enough attention to this important aspect of their future planning (see Exhibit 2). For example:

- Among family businesses, 40.9 percent have a financial succession plan in place.

- Among those businesses that are being run by the founder, 37.5 percent have a plan in place.

- Among those being run by an heir who inherited control, 42.6 percent have a plan in place.

Very often, financial succession plans are interlaced with, or subsumed under, a wealthy family’s estate plan. This does not mean that as part of the estate plan there are times when the family that owns the business is not transferring ownership—usually incrementally—to the next generation during their lives. It is just that built into their estate plans are instructions that ensure the final transfer of ownership rights.

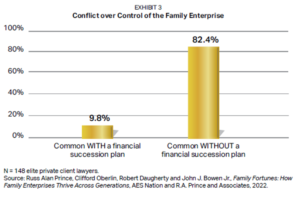

The lack of a financial succession plan can have ramifications beyond tax liabilities. If there is no definitive financial succession plan in place, there is a higher likelihood of conflicts and battles between family members—a scenario seen often by elite private client lawyers who work with entrepreneur families (see Exhibit 3). Conflict over the control of the enterprise occurs far less among families that have a financial succession plan in place, these lawyers report.

Even with a financial succession plan set, there can be family conflicts. Still, with the plan set, conflict—especially severe conflict—is considerably less likely. Therefore, any potential damage to you, your family and your family enterprise is meaningfully lessened.

The operational succession plan

Whereas financial succession plans are often said to deal with the technical side—which may be referred to as the “hard” aspects of succession planning—operational succession planning is often said to deal with the “soft” aspects. But both are typically essential to ensure the continuity of the family business.

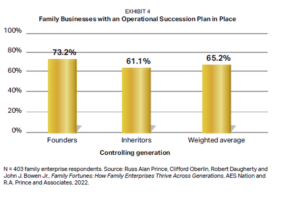

Among entrepreneurs, the news is better here. As seen in Exhibit 4, a full 65.2 percent of family businesses have an operational succession plan in place. Those businesses currently run by their founders are especially likely to have such a plan—73.2 percent. And the majority (61.1 percent) of inheritor-controlled family businesses have such a plan.

In general, top-level family business owners recognize that learning how to run the company is critical for continuity—and this regularly requires operational succession planning. In many instances, one part of that planning is the development of networking skills. More than 70 percent of the business owners said that they desire to improve their networking skills to be able to more effectively connect with other business owners, professionals and resources. This interest in improving networking skills is more pronounced among inheritors (76.9 percent) than founders (60.7 percent).

Meanwhile, it appears that the inheritors of family businesses are by and large ready to grab the reins. Among inheritors of family businesses, a full 79.6 percent say they are well prepared to take over the family enterprise. This is likely because so many family businesses have an operational succession plan implemented. Another possible reason: Very likely, a large percentage of these individuals “grew up” in the business and have seen it up close for much of their lives.

Flexibility is key

Having these types of succession plans in place can be crucial to a business’s continued success. But also be aware that the best succession plans are flexible. If the succession plan is not adaptable, unforeseen events can prove ruinous. At the same time, a well-designed succession plan has clear objectives. What will happen and how it will happen are clearly delineated. The roles and responsibilities of ultra-wealthy family members—those inheriting the family enterprise and those not—are spelled out.

Thus, issues related to the financial and operational succession plans become important—such as the desire for family harmony or the role of philanthropy in the family.

In the end, it can be especially beneficial if you (and your family members involved in your business) think about succession planning more as an ongoing process than as a one-time event. When succession planning is inculcated into the thinking of your family, the probability of the transition going well can increase dramatically. For example, if you make succession planning a regular and recurring topic on your family agenda, the likelihood is that many potential complications will get worked out before they come to a head.

The upshot: Set aside time to do succession planning as soon as possible—and revisit it regularly to help ensure your business, your family and your transition plans remain on track.

Important Disclosures

VFO Inner Circle Special Report

By John J. Bowen Jr.

© Copyright 2023 by AES Nation, LLC. All rights reserved.

No part of this publication may be reproduced or retransmitted in any form or by any means, including but not limited to electronic, mechanical, photocopying, recording or any information storage retrieval system, without the prior written permission of the publisher. Unauthorized copying may subject violators to criminal penalties as well as liabilities for substantial monetary damages up to $100,000 per infringement, costs and attorneys’ fees.

This publication should not be utilized as a substitute for professional advice in specific situations. If legal, medical, accounting, financial, consulting, coaching or other professional advice is required, the services of the appropriate professional should be sought. Neither the author nor the publisher may be held liable in any way for any interpretation or use of the information in this publication.

The author will make recommendations for solutions for you to explore that are not his own. Any recommendation is always based on the author’s research and experience.

The information contained herein is accurate to the best of the publisher’s and author’s knowledge; however, the publisher and author can accept no responsibility for the accuracy or completeness of such information or for loss or damage caused by any use thereof.

LPL Tracking #526301